In the literature, the implied probability density is known as the “risk neutral density”. Changes in information on actual probabilities or changes in risk preference can affect the output of the model.

There has been much written about the limitations of textbook decision theory in the economics and operations research literature. Textbook decision theory assumes probability estimates are independent of utility. I alluded to it in this post:

I speculate that changes in risk preference (ie. utility) are related to those factors K^2 call “evolutionary” and are hard to put into words. Regardless, IJ Good would consider changes in utility as information.

Being derived entirely from logical considerations, theoretical and empirical option pricing models are a beautiful achievement of the De Finetti - Savage - Radical Subjective Bayesian school of thought (which is closely related to the Cox-Jaynes Maximum Entropy perspective). They deserve greater attention if we wish to place applied stats in an information theoretic perspective.

The true value of implied probabilities is to get an individual to think: “What do I know that has not been factored into the price?” I’ve found the device of betting games and their valuation extremely useful in detecting when the data analysis practices in entire fields of inquiry are so bad as to be called “pathological.”

For Further Study

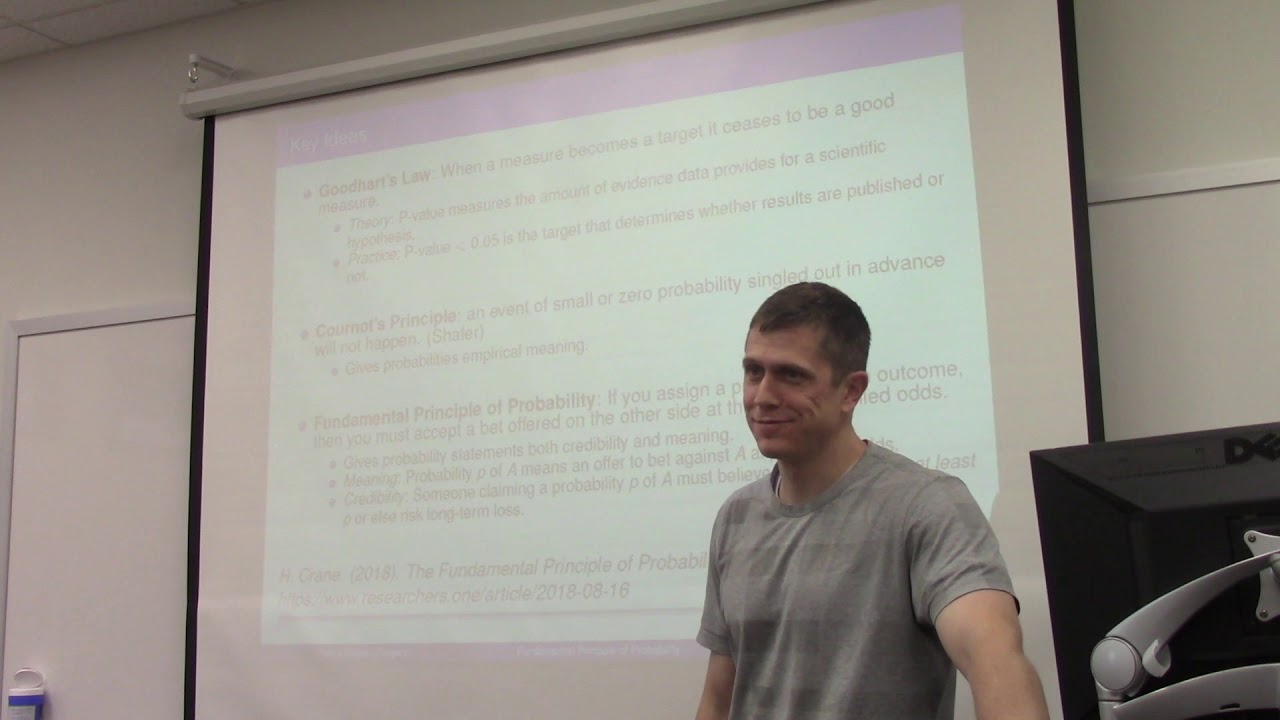

Harry Crane on Fundamental Principle of Probability

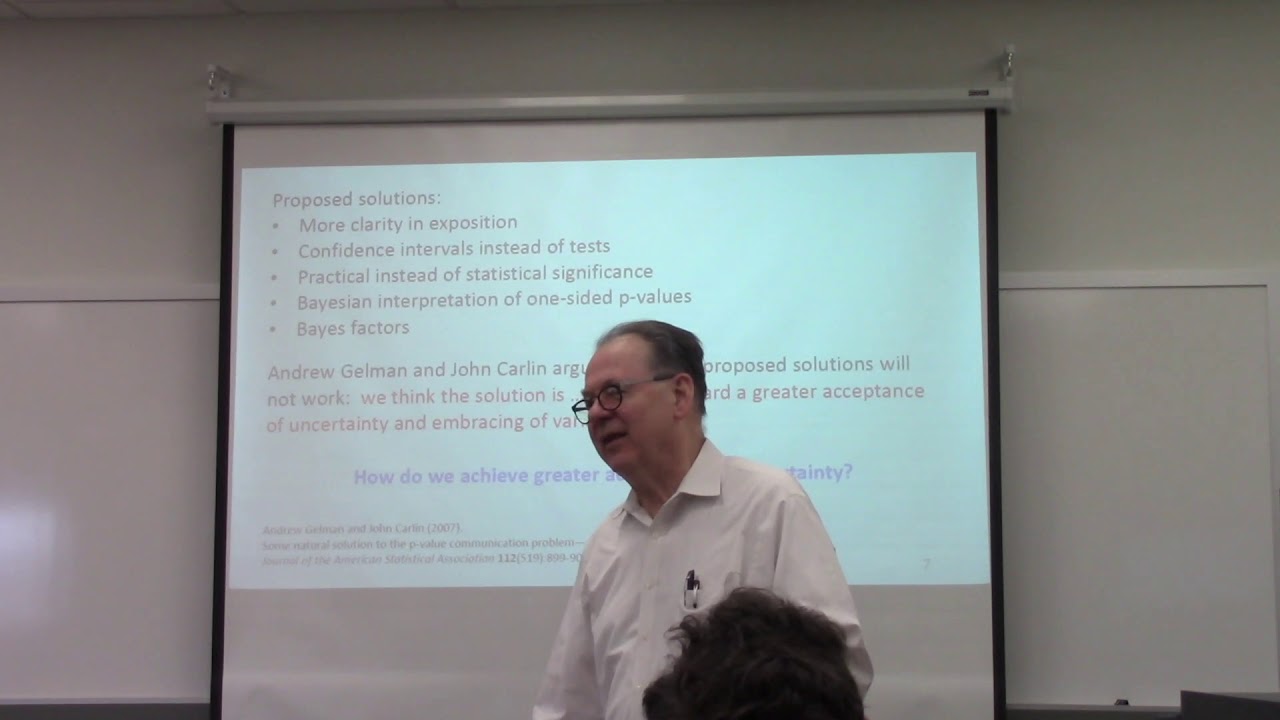

Glenn Shafer on Testing by Betting as a method of Scientific Communication. This was presented a few years before his more formal paper in the Royal Statistical Society.